BBC News

BBC Indonesian

Gety pictures

Gety picturesWhen US President Donald Trump struck China with definitions in his first term, Vietnamese businessman Hoy saw if an opportunity.

His company is one of the hundreds of companies that have appeared to compete with Chinese exports that are increasingly facing restrictions from the West.

LE’s SHDC Electronics, which is located in the emerging industrial axis of Hai Duong, sells 2 million dollars (1.5 million pounds) every month to the United States.

But these revenues may dry out if Trump imposes a 46 % tariff on Vietnamese goods, Plan currently pending Until early July. This will be “disastrous for our business”, as if.

“We cannot compete with Chinese products, and sell to Vietnamese consumers is not an option:” We cannot compete with Chinese products. This is not only our challenge. Many Vietnamese companies are struggling in their local market. “

In 2016, the Trump tariff sent an abundance of cheap Chinese imports, which was originally intended for the United States, to Southeast Asia, damaging many local manufacturers. But they also opened new doors for other companies, often in global supply chains that wanted to reduce their dependence on China.

But Trump 2.0 threatens to close these doors, which he considers an unacceptable loophole. This is a blow to fast -growing economies such as Vietnam and Indonesia, which shoots at the main players in industries from chips to electric cars.

They also find themselves stuck among the world’s largest economists – China, strong neighbors and their largest commercial partner, and the United States, a major export market, which can search for a deal at the expense of Beijing.

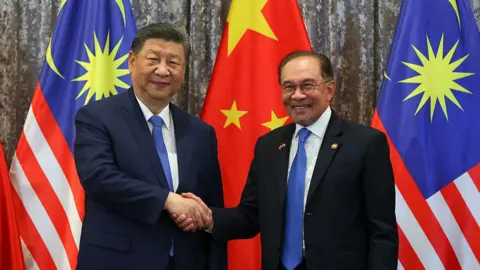

Thus, Shi Jinping’s long -planned trip to Vietnam, Malaysia and Cambodia this week took a new urgency.

All the three countries have launched the red carpet for him, but Trump saw it as evidence of them Conspiracy to the US “screw”.

Gety pictures

Gety picturesThe White House will use its upcoming negotiations with smaller countries to pressure them to reduce their dealings with Beijing, according to reports.

But this could be a fictional ambition due to the amount of money that flows between China and Southeast Asia.

In 2024, China got a record number of 3.5 tennis of exports – 16 % of these went to Southeast Asia, its largest market. Beijing paid the price of railways in Vietnam, the dams in Cambodia and the ports in Malaysia as part of the “Belt and Road” program that seeks to strengthen relations abroad.

“We cannot choose, and we will never choose (between China and the United States),” BBC told BBC on Tuesday before Shi’s visit.

“If the case revolves around something we feel against our interest, we will protect (ourselves).”

An invitation to wake up

in Days after Trump revealed his full definitionsSoutheast Asian governments rushed to make deals.

In what Trump described it as a “very fruitful call” with the Vietnamese leader LAM, the latter offered to cancel the tariff completely on American goods.

The American market is very important for Vietnam, which is the emerging electronics force as manufacturing giants such as Samsung, Intel and Foxconn, which has been contracted with the Taiwanese company to make iPhone devices.

Meanwhile, Thai officials are heading to Washington with a plan that includes higher American imports and investments. The United States is the largest export market, so they hope to avoid a 36 % tax on Thailand that Trump may return.

“We will tell the United States government that Thailand is not only a source, but also an ally and economic partner that the United States can rely on in the long term,” said Prime Minister Petonghern Shinwatra.

The Association of Southeast Asian Countries (ASEAN) has excluded revenge on the Trump tariff, and instead chose to emphasize its economic and political importance to the United States.

Gety pictures

Gety pictures“We understand the fears of the United States,” Mr. Zrolol told the BBC. “That is why we need to show that we are in fact, we can be this bridge, especially Malaysia,”.

It is the role of Southeast Asian economies that are well -based on export – they have benefited from both Chinese trade and investment and the United States. But Trump’s parked fees can hinder it.

Take Malaysia, for example. In recent years, chips manufacturers have invested from the United States and other places there, as Washington prohibits the sale of advanced technology to China. Last year, China imported $ 18 billion in Malaysia chips. These chips are used in Chinese electronics, such as iPhone devices, usually associated with the United States.

Trump’s proposed tariff for Malaysia – 24 % – can cut the US -billion -dollar market. But this is not all.

“If this continues, companies will have to rethink their investment obligations.” “This will have an impact not only on the Malaysian economy, but on the global economy.”

Then there is Indonesia, which may face a 32 % tariff, which is home to the vast nickel reserve and has its features in the global electric car supply chain.

Cambodia, Chinese ally, face the harshest drawings: 49 %. One of the poorest countries in the region, has flourished as a axis by shipping to Chinese companies that seek to avoid customs tariffs. Chinese companies currently have or run 90 % of clothing factories, which are mainly issued to the United States.

“Perhaps Trump has stopped this tariff, but” the damage caused, “says Doris Leo, an economist at the Institute of Democracy and Economic Affairs in Malaysia.

“This is an invitation to wake up to the region, not only to reduce dependence on the United States, but also to balance the excessive dependence on any commercial partner and export.”

The loss of China and Southeast Asia’s profit

In these unspecified times, Xi Jinping is trying to send a fixed message: Let’s join hands and “Bulling” resistance from the United States.

This is not an easy task because Southeast Asia also has trade tensions with Beijing.

In Indonesia, the business owner, Savaret, is concerned that the Trump tariff at 145 % on China means more competition from Chinese competitors who can no longer export to the United States.

“Small companies like us feel pressure,” says Sleepwear Brand Helopy. “We are struggling to stay against a very Chinese products.”

Gety pictures

Gety picturesIt sells one of the famous Helopopy pajamas for $ 7.10 (119,000 Indonesian rupees). ISMA says she has seen similar designs from China is going about half this price.

“I have become Southeast Asia, which is approaching, with open trade systems and fast -growing markets, the floor “Politically, many countries are reluctant to confront Beijing, adding another layer of weakness.”

While consumers welcomed Chinese products with competitive prices – from clothes to shoes to phones – thousands of local companies were unable to match these low prices.

It has closed more than 100 factories in Thailand every month over the past two years, according to a discretion from the Thai thought reservoir. During the same period in Indonesia, about 250,000 workers of fabric were demobilized after about 60 clothes manufacturers were closed.

“When we see the news, there are a lot of imported products that flood the local market, which is tampered with our market,” said Mikhaati, the worker who was demobilized from SRITEX in February after 30 years, for BBC.

“Maybe our luck,” says 50 -year -old, who is still looking for work. “Who can we complain about? No one.”

Gety pictures

Gety picturesSoutheast Asian governments responded with a wave of protectionism, as local companies demanded protection from the impact of Chinese imports.

Last year, Indonesia looked at the customs tariffs by 200 % on a group of Chinese goods and banned the Temu e -commerce website, which is popular among Chinese merchants. Thailand tightened import inspections and imposed an additional tax on the goods of less than 1500 Thai baht ($ 45; 34 pounds).

This year, Vietnam imposed temporary duties to combat dumping on Chinese Chinese products. After the recent announcement of the Trump tariff, Vietnam was scheduled to launch the Chinese goods that are shipped across its territory to the United States.

Calling these concerns was on the agenda of Xi this week.

China indicates that directing its exports related to the United States to the rest of the world “will really end up to alienate and exacerbate” its commercial partners, said David Rene, the former head of the Beijing office of the Economists newspaper, told BBC’s Newshour.

“If the matter ends with a wave of Chinese exports to the sinking of these markets and their attribution and jobs … This is a huge diplomatic and geopolitical headache for the Chinese leadership.”

China has always had an easy relationship with this region. With the exception of Laos, Cambodia and Myanmar, the war, and others are warning of Beijing’s ambitions. Regional conflicts in southern China have tense relations with the Philippines. This is also an issue with others like Vietnam and Malaysia, but trade was a budget factor.

But this may change now, as experts say.

Gety pictures

Gety pictures“Southeast Asia had to think if they really wanted to offend China. This is now complicating things,” says Chung Ja Ean, Associate Professor at the National University of Singapore.

China’s loss in Southeast Asia can be.

“In the past, American buyers will take months to replace suppliers. Today, such decisions are made within days,” says Hao Lu, in Vietnam, that he has seen an increase in inquiries from American clients discovered for new electronics suppliers outside China.

Malaysia, with sprawling rubber farms and the largest medical glove maker in the world, has nearly half of the world market for rubber gloves. But it is used to seize a greater share of its main rival, China.

The region still faces a 10 % basic tariff, like most of the world. This is bad news, “says On Kim Hong, President of the Malaysian rubber gloves Association.

But even if the targeted tariff begins, customers will find an additional 24 % of Malaysian gloves that are largely preferred over the 145 % tax that will have to cough for Chinese -Chinese gloves.

“We do not jump exactly with joy, but this may benefit our manufacturer, as well as those in Thailand, Vietnam and Cambodia.”

In additional reporting, Abraram, Subanam

https://ichef.bbci.co.uk/news/1024/branded_news/cdee/live/d34101d0-1b4d-11f0-a455-cf1d5f751d2f.jpg

Source link