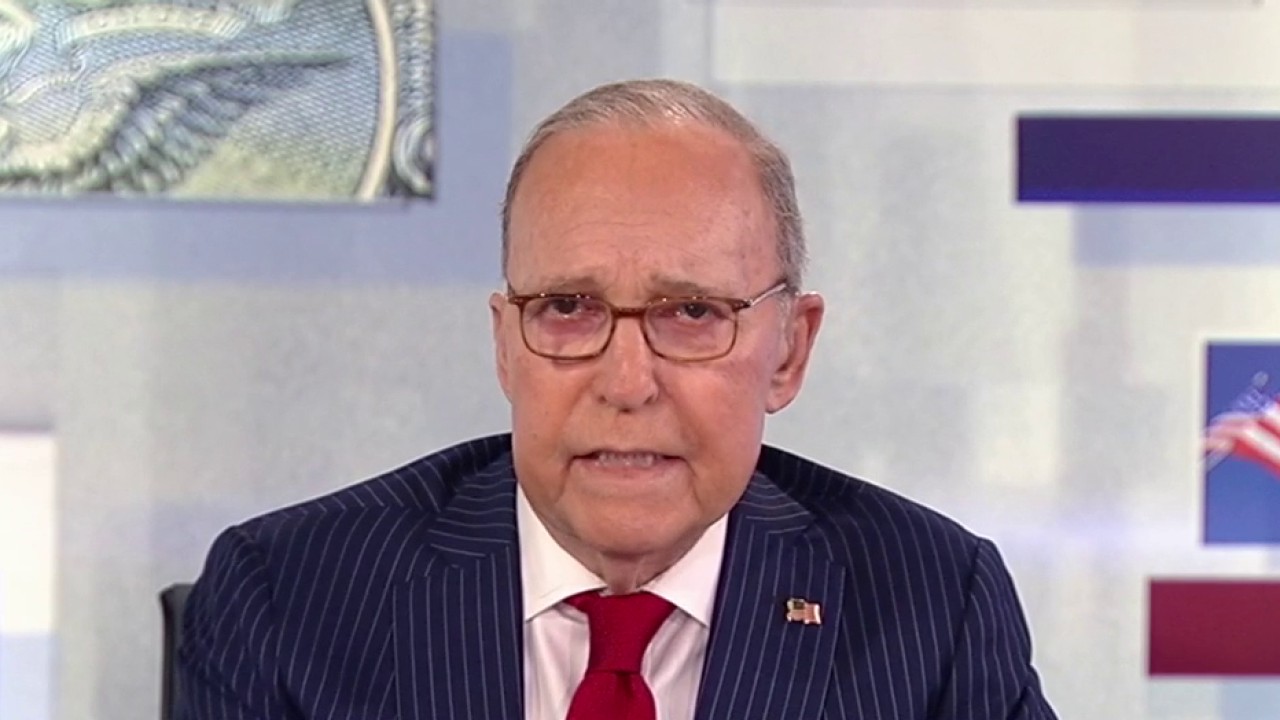

Fox Larry Kudlo’s business host separates the taxes and growth policy to “Kodlow”.

The majority leader of the Senate John Thun has set a final date on April 11 for a final agreement between the Republics of the House President Donald Trump “One, big, beautiful” invoice.

Let’s hope it is right. Let’s hope that both councils will meet on the deadline. There is a lot of work to do it.

It has become familiar with some conservatives to beat Republicans in the Senate because of their slow.

Perhaps this Bell “one, big, beautiful”.

Many Senate members are translating Djendo budget savings in Elon Musk In at least one package and possibly more cancellation packages that will retract spending, mainly tearing the check.

There is a budget package for the border, deportation, energy repair, and military increases. It should not be very difficult to patch Mr. Krabo’s tax plan on it.

However, the house has a lot of work to do it too.

Congress reporting reports at Fox News Chad Pexram about President Donald Trump pushing him quickly to extend the previous tax discounts on “Kudlo”.

It is a miracle, Mike Johnson spokesman got a budget, and I am happy because he drew the first blood.

But there are a lot of problems in solving the home budget.

To anyone, it does not make Permanent Trump tax discounts.

For another, the current political foundation line of Senator Krabo does not include a accounting device that makes tax cuts permanently based on a neutral impotence. It was used by former President Barack Obama due to the permanent tax cuts that do not need to be reformulated every few years.

Instead, the house produced a way to reach spending cuts and tax discounts. This is a big mistake.

It reminds me of the years before the quarter, when the Republicans in Nixon Ford have always waited to reduce the deficit before lowering taxes. Since they do not reduce deficit or spending, they are never less taxes.

Fortunately, Reagan broke that high -tax doctrine.

But some Republicans in the House of Representatives have returned to the trap of taxes.

The members of the “Kudlow” committee, Steve Forbes, Art Lvever and Steve Moore, are discussing the development of the economy and the response to inflation.

Another problem for the Senate and the Republican House of Representatives provides Trump tax discounts 2.0, because the current political foundation line applies only to Trump tax discounts 1.0.

Tax-exempt, additional work, social security advantages, 15 % of “America” reduce corporate tax, and a 100 % reactionary expenditures for factories-these are all wonderful new policies, but they do not fall under this rule.

You can all put them in one invoice. But this remains to see.

This will require some of the main dynamic growth registration in the league to calculate the growth of Lavir curve revenue from the width side.

In other words, both Republican councils are still a long stone’s goal from a boom with a tax -paid blue wolves.

However, with the spirit of Ronald Reagan, Donald Trump saw the deal.

https://a57.foxnews.com/static.foxbusiness.com/foxbusiness.com/content/uploads/2025/03/0/0/larry-kudlow-6.jpg?ve=1&tl=1

Source link